A look back at the stock market

Share

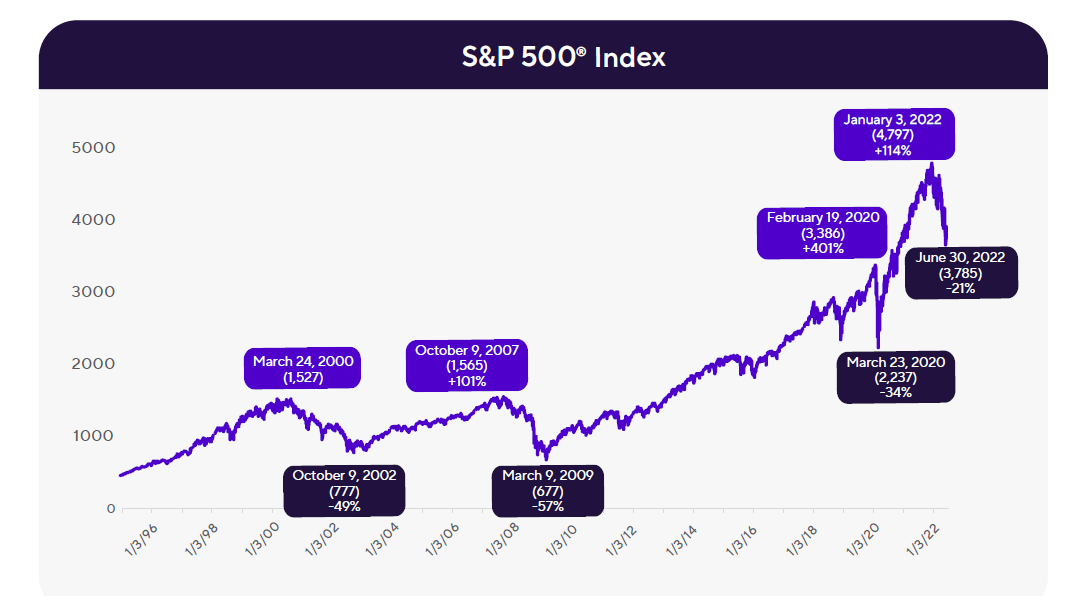

Historically, investing in the stock market has delivered positive trends over the long-term, but what goes up can also come down. While past performances are not always indicative of future results, the right strategy might help you ride the waves of market volatility.

Historically, investing in the stock market has delivered positive trends over the long-term, but what goes up can also come down. While past performances are not always indicative of future results, the right strategy might help you ride the waves of market volatility.

The order in which you encounter positive or negative investment returns—known as the “sequence of returns”—poses a retirement risk that should not be ignored. If you experience a market downturn, it may increase the possibility of eventually running out of money. Of course, no one can control the sequence of returns, but there are strategies that can help you cope with this retirement risk.

This illustration is based on on historical S&P 500® Index Adjusted Daily Closing Prices for the period 1/3/95 – 6/29/22. The S&P 500® Index is one of the most commonly used benchmarks for the U.S. Stock Market. You cannot invest directly with them. Performance illustrated is not indicative of future results.

Market volatility is to be expected over time, but an adverse stock market as you near retirement could derail your plans. Altering your mix of investments is one way to possibly help lessen the impact of market volatility. You can always talk things over with a licensed financial professional.

We’re here to help you take action.

Maura Esten

Financial Advisor

410 Amherst Street, Suite 310, Nashua, NH 03063

Office: 603.594.8340

Cell: 207.272.7957

maura.esten@corebridgefinancial.com

Mark Roberts

Financial Advisor

410 Amherst Street, Suite 310, Nashua, NH 03063

Office: 603.594.8340

Cell: 207.747.8966

mark.roberts@corebridgefinancial.com