Asset Allocation by AIG

Share

Find your optimal mix of investment risk and return.

Find your optimal mix of investment risk and return.

An idea so good it won a Nobel Prize.

Strategic asset allocation might be the single most important factor in your retirement investment plan. The idea began in 1952 when economist Harry Markowitz demonstrated that …

- The risk of any investment should not be viewed in isolation, but instead how that investment contributes to overall portfolio risk

- Optimal asset allocation for a given level of expected risk or return can be calculated using optimization formulas

These formulas help you reduce risk by combining investments with dissimilar performance characteristics, the result being an investment mix with combined investments that carry less overall risk than the individual investments in the mix.

While it is a proven investment tool, please bear in mind that asset allocation does not ensure a profit or protect against market loss. The goal is to achieve the highest expected return for a given level of risk.

Why dissimilar performance characteristics matter.

The theory says if you have one stock that “zigs,” you should have another stock that “zags.” You see, each investment class and category has definite behavior characteristics. If two investments behave the same, they are said to be positively correlated (see graph). That can be great when both investments are doing well, but scary when they’re not.

Asset allocation.

Find your optimal mix of investment risk and return.

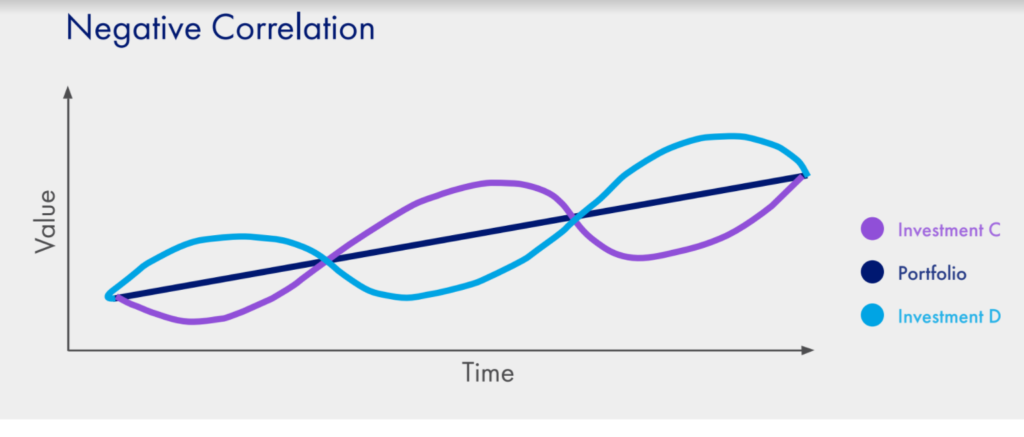

Choosing positively correlated investments could take you on a roller coaster ride in a volatile market. But note in the second graph how investing in stocks that behave differently from one another (negative correlation) can help to smooth a volatile market.

Help when you need it.

Don’t feel like you have to go it alone. We can help you cope with an uncertain market, and you can always talk things over with a licensed financial professional.

Mark Roberts

Financial Advisor

410 Amherst St, Suite 310

Nashua, NH 03063

Office: 603-594-8340

Cell: 207-747-8966

mark.roberts@aig.com

We see the future in you.SM

CLICK aig.com/RetirementServices CALL 1-800-426-3753 VISIT your financial professional

Securities and investment advisory services offered through VALIC Financial Advisors, Inc. (VFA), member FINRA, SIPC and an SEC-registered investment adviser.

Annuities are issued by The Variable Annuity Life Insurance Company (VALIC), Houston, TX. Variable annuities are distributed by its affiliate, AIG Capital Services, Inc. (ACS), member FINRA.

AIG Retirement Services represents AIG member companies — The Variable Annuity Life Insurance Company (VALIC) and its subsidiaries, VALIC Financial Advisors, Inc. (VFA) and VALIC Retirement Services Company (VRSCO). All are members of American International Group, Inc. (AIG).

© American International Group, Inc. All rights reserved.