Just starting to save?

Share

Don’t fret over market volatility—focus on the big opportunities.

The stock market has a history of fluctuating, so a drop in value is nothing new. It’s important that you avoid making rash moves in response to market ups and downs and remain focused on your future goals.

The stock market has a history of fluctuating, so a drop in value is nothing new. It’s important that you avoid making rash moves in response to market ups and downs and remain focused on your future goals.

Consider the opportunity in front of you:

Discount Shopping

When is the best time to shop? Generally, when there’s a sale. Market volatility could be considered similarly. A drop in stock prices could mean stocks are on sale, so even though your account values drop, you can now buy stocks at a discount. This is an important opportunity, especially if you have more time to save. By constantly contributing when markets are lower, you buy more shares and potentially benefit as the markets rebound over time.

Dollar-cost Averaging

As stock markets rise, you buy less shares with that money. If you continue investing consistently, you potentially benefit from fluctuating markets. This is called dollar-cost averaging.

Of course, dollar-cost averaging does not assure a profit and does not protect against market loss. This type of plan involves continuous investment in securities regardless of fluctuating price levels, so you should consider your financial ability to continue purchasing through periods of both high and low level prices.

Put time on your side

Many people who enter the workforce in the last decade or so may feel like their veteran colleagues have it made: more vacations, more pay, better offices, etc. But the younger generations have something that the elder generations likely crave: Time. Taking full advantage of it can be a move in the right direction.

Social security was meant to only replace a portion of your salary and therefore may not cover all your retirement needs. Setting aside some of your money can help to alleviate some of the shortfall. Waiting a few years to start saving means needing to save more later. By starting earlier, saving may be easier because you can make smaller contributions over a longer time period. More time also means more opportunity to potentially benefit from compounding growth.

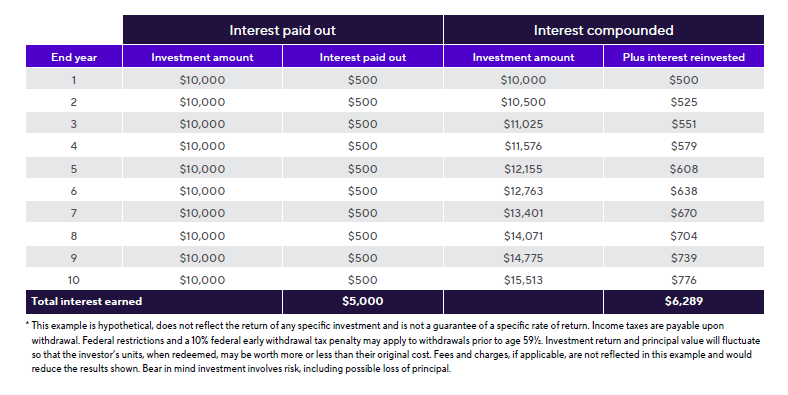

Time and money

Compounding is growing your returns by reinvesting any gains your money earns. Say Ralph invests $10,000 at an annual 5% interest rate. If he had the interest paid to him, Ralph would earn $5,000 after 10 years. But if he reinvested it back into the account, it would compound to $6,289 by year 10 – an additional $1,289, an increase of almost 12%.