Retirement plan contribution limits for 2022

Share

Opportunity to prepare for the future you envision.

Opportunity to prepare for the future you envision.

When you participate in your employer’s tax-deferred plan, your pretax contributions can potentially help reduce your current taxable income. That means you can save dollars for retirement that otherwise would have gone to pay taxes.

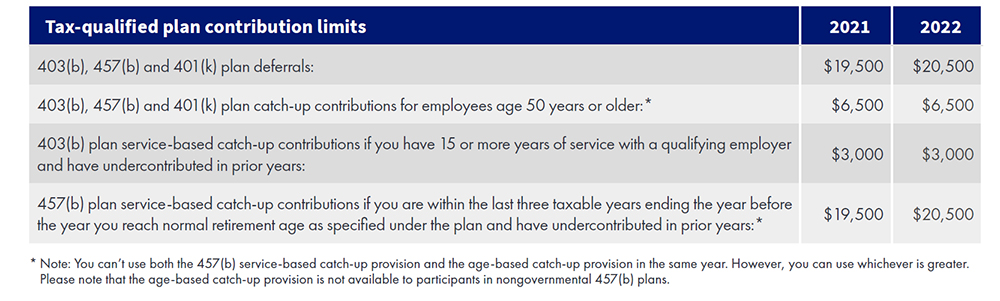

The table below shows the maximum amount you can contribute to some plans.

CLICK aig.com/RetirementServices | CALL 1-800-426-3753 | VISIT your financial professional

This material is general in nature, was developed for educational use only, and is not intended to provide financial, legal, fiduciary, accounting or tax advice, nor is it intended to make any recommendations. Applicable laws and regulations are complex and subject to change. Please consult with your financial professional regarding your situation. For legal, accounting or tax advice consult the appropriate professional.

Securities and investment advisory services offered through VALIC Financial Advisors, Inc. (VFA), member FINRA, SIPC and an SEC-registered investment adviser.

Annuities are issued by The Variable Annuity Life Insurance Company (VALIC), Houston, TX. Variable annuities are distributed by its affiliate, AIG Capital Services, Inc. (ACS), member FINRA.

AIG Retirement Services represents The Variable Annuity Life Insurance Company (VALIC) and its subsidiaries, VALIC Financial Advisors, Inc. (VFA) and VALIC Retirement Services Company (VRSCO). All are members of American International Group, Inc. (AIG).